.webp?width=297&height=100&name=Peppol-Access-Point-CMYK-scaled%20(1).webp)

E-Invoicing in UAE

Be prepared for future e-invoicing regulations in the UAE with Infinite – a secure, automated and Peppol-certified solution built for VAT compliance and digital transformation.

Trusted by Leading Businesses Across the Middle East

Mandatory E-Invoicing in the UAE

Federal Tax Authority (FTA) encourages businesses to adopt digital systems in line with VAT regulations and international best practices.

The United Arab Emirates is introducing mandatory e-invoicing and digital reporting as part of its tax modernization efforts under the EmaraTax platform. The reform aims to increase transparency, ensure VAT compliance, and align with international best practices.

With neighboring countries like Saudi Arabia, Egypt, and Jordan already implementing national e-invoicing systems, the UAE is expected to follow suit in the near future. Now is the time to prepare.

1 July

2026

Pilot phase starts. A selected group of taxpayers begins applying the e-invoicing system.

31 July

2026

Deadline for businesses with annual revenues of AED 50M+ to appoint an Approved Service Provider (ASP).

1 January

2027

Full implementation deadline for businesses with annual revenues of AED 50M+.

31 March

2027

Deadline for smaller businesses (< AED 50M) and government entities to appoint their ASP.

1 July

2027

Full implementation deadline for smaller businesses (< AED 50M).

1 October 2027

Full implementation deadline for government entities.

UAE E-Invoicing Guide 2025

Your complete roadmap to mandatory e-invoicing compliance under the UAE Federal Tax Authority’s EmaraTax system.

The UAE has officially entered a new era of digital taxation, making e-invoicing mandatory for all VAT-registered businesses. Non-compliance can mean fines, delayed refunds, rejected invoices, and audit risks.

This guide explains everything you need to know about the UAE’s new E-Invoicing Program.

Simplify UAE EmaraTax Preparation with Infinite

With extensive experience across the GCC region, Infinite helps UAE-based businesses prepare for future e-invoicing mandates with scalable, VAT-compliant solutions.

Although the UAE has not yet launched a centralized e-invoicing platform, the Ministry of Finance is actively developing regulatory frameworks. Now is the time to future-proof your invoicing and archiving infrastructure — and Infinite is ready to support you every step of the way.

Future-Ready Platform

Fully prepared for integration with upcoming UAE e-invoicing systems and regulatory changes.

Experience Across the GCC

Proven track record delivering compliant solutions in the UAE, Saudi Arabia, and wider Middle East markets.

Works with Any ERP & POS System

Easily connects with your existing ERP or accounting systems — no major process disruption.

Dedicated Regional Support

6+ Years in the Middle East. Expert assistance in both Arabic & English.

Why Infinite for UAE E-Invoicing Compliance

- Compliant with UAE VAT Recordkeeping – Designed to meet FTA requirements for secure electronic storage and audit-ready documentation under the UAE VAT Law.

- Flexible Invoice Upload: Upload invoices in bulk or individually using formats such as PDF, Excel, and CSV.

- Secure E-Archiving: Rely on tamper-proof digital archiving and fast retrieval. Our advanced encryption guarantees the integrity of your data and meets national requirements.

- Comprehensive Support: Our solution covers onboarding, API integration, project management, and user acceptance testing (UAT) to ensure a smooth and successful setup.

- Secure, Tamper-Proof Transactions – Protect your financial data with encrypted processing.

- Seamless Integration with Your ERP/POS – Connect instantly to your existing system.

- Scalability & Flexibility: Whether you’re a small local firm or a large enterprise, Infinite’s cloud-based platform scales with your business, accommodating fluctuating transaction volumes.

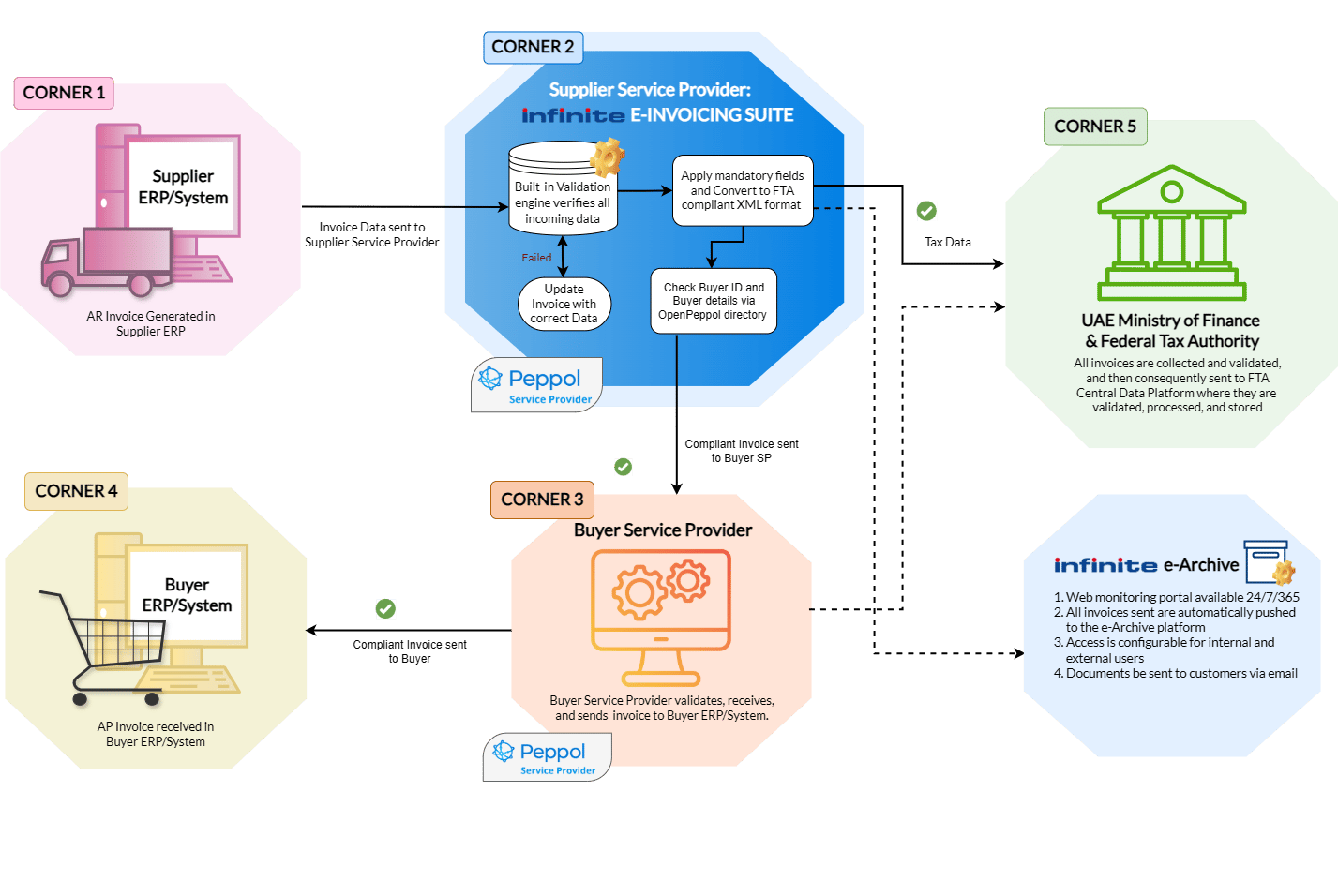

Integration with any ERP/POS

Infinite connects your existing business systems with your UAE e-invoicing and compliance requirements — without disrupting daily operations. We integrate directly with leading ERP, finance, CRM, and retail POS platforms to streamline invoice data flow, automate validations, and ensure consistent reporting across your organization.

Our solution supports integrations with platforms such as SAP, Microsoft Dynamics 365, Oracle, NetSuite, Infor, IFS, Sage, Odoo, and Salesforce, as well as flexible connectivity via API or SFTP — depending on your architecture and IT preferences.

Integrate with UAE E-Invoicing Regulations!

Prepare your business for upcoming UAE e-invoicing regulations with Infinite – a trusted regional provider of compliant invoicing, archiving, and automation solutions built to meet FTA standards.

FAQs

-

What are the current rules for e-invoicing in the UAE?

There is no mandatory e-invoicing requirement yet. However, businesses can voluntarily exchange e-invoices if both trading parties agree on the format and communication channel. -

What is the legal basis for electronic documents in the UAE?

The UAE's Electronic Transactions and Trust Services Law provides a legal foundation for using digital documents and signatures. It defines how electronic records are created, sent, stored, and recognized in legal and tax matters. -

Is e-invoicing mandatory in the UAE?

Not yet — but it will be. The Ministry of Finance plans to release official e-invoicing legislation in Q2 2025, with the first mandatory phase for B2B and B2G transactions expected to begin in Q2 2026. -

Will UAE e-invoicing follow the Peppol model?

Although details have not been finalized, early indicators suggest that the UAE may adopt a Peppol-based framework, similar to Malaysia and parts of Europe, to support interoperability and international trade. -

How can I prepare for UAE e-invoicing?

You can start by adopting systems that generate structured e-invoices (XML, UBL), implementing digital signatures, and ensuring VAT-compliant archiving. Infinite’s eArchive and automation tools can support early adoption and future readiness.