UAE E-Invoicing

Connect to

EmaraTax platform

✅ Trusted provider

✅ Works with any ERP

✅ Dedicated local support

✅ Comply with FTA's e-invoicing regulations

Get Your Free UAE E-Invoicing Guide

Trusted by Leading Businesses Across the Middle East

30 October 2024

The UAE introduced changes to its VAT legislation that lay the groundwork for e-invoicing, formally acknowledging digital invoicing within its tax framework.

6 February 2025

The Ministry of Finance initiated a public feedback round to gather input on technical and data-related aspects of the upcoming e-invoicing system.

Q2 2025

New regulations outlining the national e-invoicing framework are expected to be officially released by mid-2025.

Q2 2026

Initial rollout of mandatory e-invoicing is planned to begin, covering both B2B and B2G transactions.

UAE E-Invoicing Guide 2025

Your complete roadmap to mandatory e-invoicing compliance under the UAE Federal Tax Authority’s EmaraTax system.

The UAE has officially entered a new era of digital taxation, making e-invoicing mandatory for all VAT-registered businesses. Non-compliance can mean fines, delayed refunds, rejected invoices, and audit risks.

This guide explains everything you need to know about the UAE’s new E-Invoicing Program.

Why Infinite for UAE FTA E-Invoicing Compliance

- Compliant with UAE VAT Recordkeeping – Designed to meet FTA requirements for secure electronic storage and audit-ready documentation under the UAE VAT Law.

- Flexible Invoice Upload: Upload invoices in bulk or individually using formats such as PDF, Excel, and CSV.

- Secure E-Archiving: Rely on tamper-proof digital archiving and fast retrieval. Our advanced encryption guarantees the integrity of your data and meets national requirements.

- Comprehensive Support: Our solution covers onboarding, API integration, project management, and user acceptance testing (UAT) to ensure a smooth and successful setup.

- Secure, Tamper-Proof Transactions – Protect your financial data with encrypted processing.

- Seamless Integration with Your ERP/POS – Connect instantly to your existing system.

- Scalability & Flexibility: Whether you’re a small local firm or a large enterprise, Infinite’s cloud-based platform scales with your business, accommodating fluctuating transaction volumes.

Simplify UAE EmaraTax Preparation with Infinite

With extensive experience across the GCC region, Infinite helps UAE-based businesses prepare for future e-invoicing mandates with scalable, VAT-compliant solutions.

Although the UAE has not yet launched a centralized e-invoicing platform, the Ministry of Finance is actively developing regulatory frameworks. Now is the time to future-proof your invoicing and archiving infrastructure — and Infinite is ready to support you every step of the way.

Future-Ready Platform

Fully prepared for integration with upcoming UAE e-invoicing systems and regulatory changes.

Experience Across the GCC

Proven track record delivering compliant solutions in the UAE, Saudi Arabia, and wider Middle East markets.

Works with Any ERP & POS System

Easily connects with your existing ERP or accounting systems — no major process disruption.

Dedicated Regional Support

6+ Years in the Middle East. Expert assistance in both Arabic & English.

Integrate with UAE E-Invoicing Regulations!

Prepare your business for upcoming UAE e-invoicing regulations with Infinite – a trusted regional provider of compliant invoicing, archiving, and automation solutions built to meet FTA standards.

FAQs

-

What are the current rules for e-invoicing in the UAE?

There is no mandatory e-invoicing requirement yet. However, businesses can voluntarily exchange e-invoices if both trading parties agree on the format and communication channel. -

What is the legal basis for electronic documents in the UAE?

The UAE's Electronic Transactions and Trust Services Law provides a legal foundation for using digital documents and signatures. It defines how electronic records are created, sent, stored, and recognized in legal and tax matters. -

Is e-invoicing mandatory in the UAE?

Not yet — but it will be. The Ministry of Finance plans to release official e-invoicing legislation in Q2 2025, with the first mandatory phase for B2B and B2G transactions expected to begin in Q2 2026. -

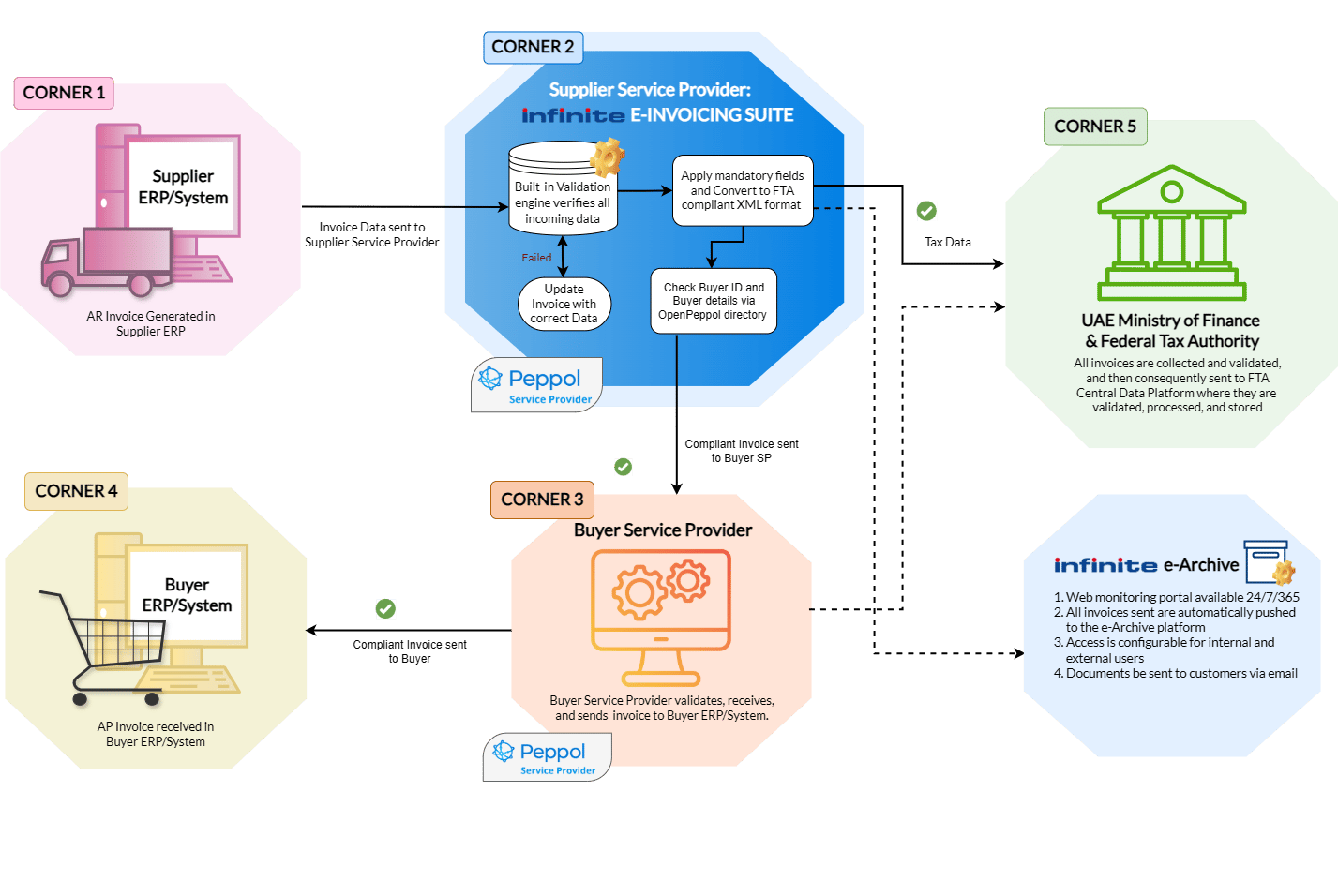

Will UAE e-invoicing follow the Peppol model?

Although details have not been finalized, early indicators suggest that the UAE may adopt a Peppol-based framework, similar to Malaysia and parts of Europe, to support interoperability and international trade. -

How can I prepare for UAE e-invoicing?

You can start by adopting systems that generate structured e-invoices (XML, UBL), implementing digital signatures, and ensuring VAT-compliant archiving. Infinite’s eArchive and automation tools can support early adoption and future readiness.