The Importance of ASP in UAE E-Invoicing

Electronic invoicing (e-invoicing) is no longer just a tech trend — it’s rapidly becoming a core tax compliance requirement for businesses operating...

Infinite has been our IT systems provider since 2004. The implementation of EDI system automated the flow of documents (such as invoices and orders). The delivery of our products takes place faster now, while the cost of order processing is noticeably lower.

Tomasz Bekasiewicz

IT Manager

Being an integral part of KSA’s e-Invoicing implementation, the taxpayer testing process has been further amplified by the Zakat, Tax and Customs Authority (ZATCA) through the launch of the Fatoora Simulation Portal last December 27, 2022.

The simulation portal is a replica of the live Fatoora portal which allows Phase 2 – wave 1 companies to further test, identify defects, reduce flaws, and increase the overall quality of their respective e-Invoicing systems in preparation for Go-Live.

This testing environment is intended to provide taxpayers with a complete e-Invoicing experience, similar to the live portal’s functionalities. This includes device onboarding, e-Invoice reporting and clearance, visibility on document statistics/report, and renewal of CSID.

FAQ’s relative to the simulation portal have also been sent out by ZATCA via email to the pilot companies last December 20, along with the official announcement on the release of the simulation portal, end of pilot testing, and Fatoora portal go-live.

Electronic invoicing (e-invoicing) is no longer just a tech trend — it’s rapidly becoming a core tax compliance requirement for businesses operating...

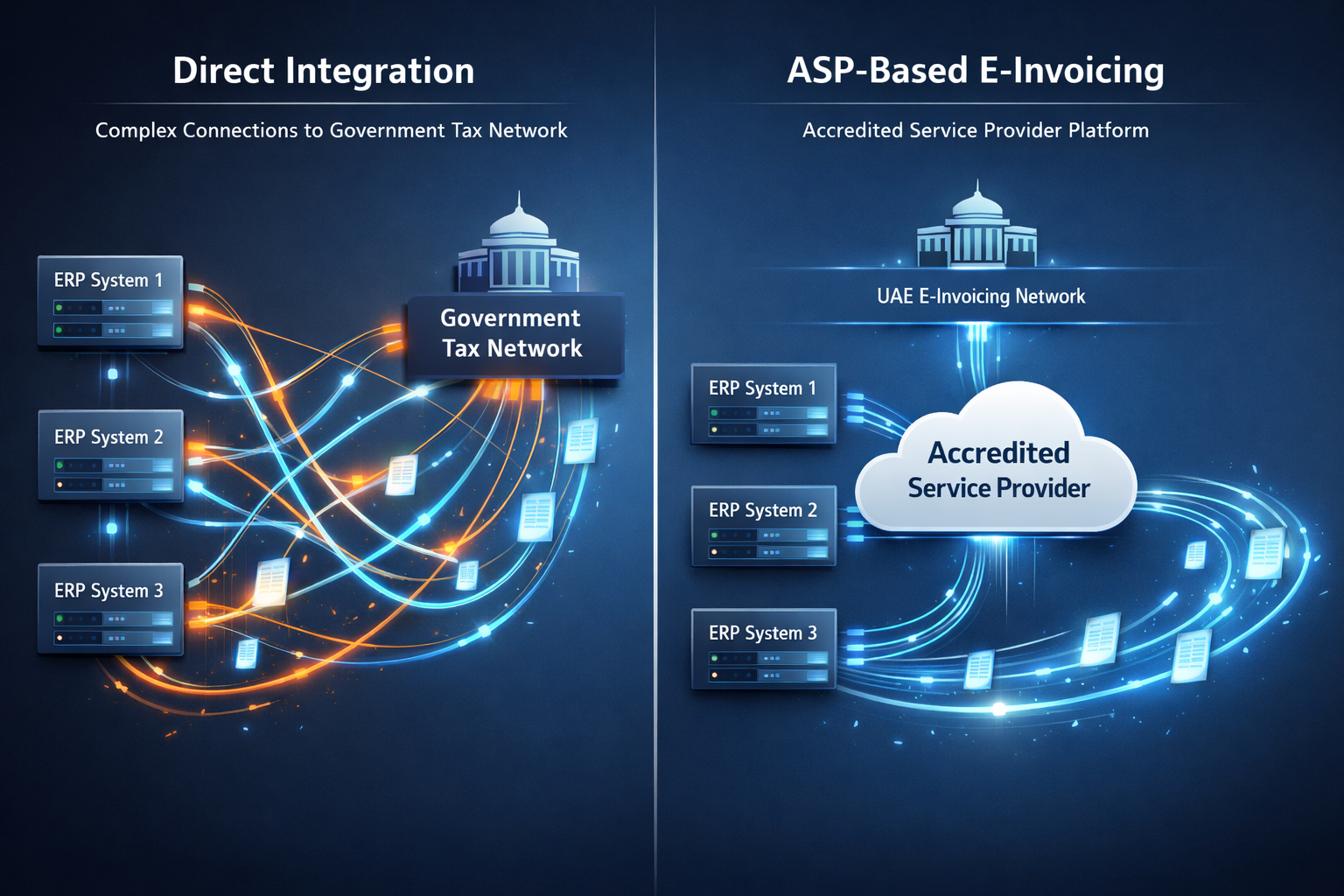

As the United Arab Emirates prepares to introduce a national e-invoicing framework, compliance with tax regulations will become an increasingly...

As the United Arab Emirates prepares to introduce a national e-invoicing framework, many businesses are evaluating how they should technically...