The Importance of ASP in UAE E-Invoicing

Electronic invoicing (e-invoicing) is no longer just a tech trend — it’s rapidly becoming a core tax compliance requirement for businesses operating...

Infinite has been our IT systems provider since 2004. The implementation of EDI system automated the flow of documents (such as invoices and orders). The delivery of our products takes place faster now, while the cost of order processing is noticeably lower.

Tomasz Bekasiewicz

IT Manager

1 min read

Admin Aug 2, 2023 12:19:49 PM

A recent announcement has been released by the Saudi Official Gazette (uqn.gov.sa) last July 28th, regarding the next group/wave of companies mandated to implement ZATCA e-Invoicing Integration Phase 2.

As previously stated, eligible companies are informed at least six months prior integration date; and in the online publication, wave/group 7 taxpayers have been identified as persons or entities whose annual revenues are subject to value-added tax that go beyond (50,000,000) fifty million Saudi Riyals for the year 2021 or 2022. The said group are mandated to connect their respective electronic invoicing systems or solutions, send simplified and tax invoices (including notifications) electronically, and share their data with the Zakat, Tax and Customs Authority for clearance and reporting within three months starting February 1, 2024, until May 31, 2024.

Aside from public announcements, qualified companies are also sent an official email by zatca.gov/Fatoora for confirmation and are assigned respective ZATCA advisors or relationship managers to be better guided in the implementation process.

Electronic invoicing (e-invoicing) is no longer just a tech trend — it’s rapidly becoming a core tax compliance requirement for businesses operating...

As the United Arab Emirates prepares to introduce a national e-invoicing framework, compliance with tax regulations will become an increasingly...

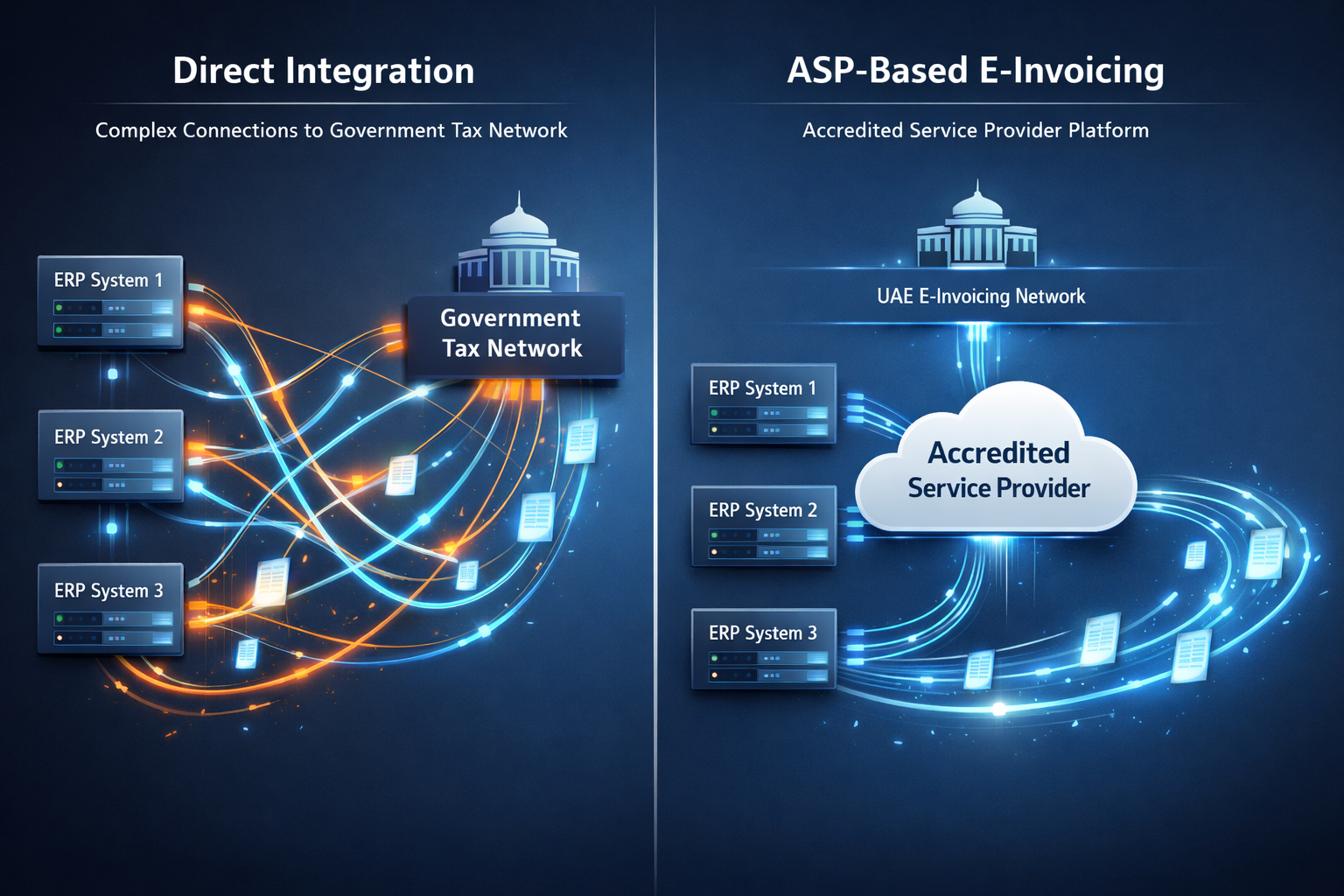

As the United Arab Emirates prepares to introduce a national e-invoicing framework, many businesses are evaluating how they should technically...